Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of 1023 ez form pdf?

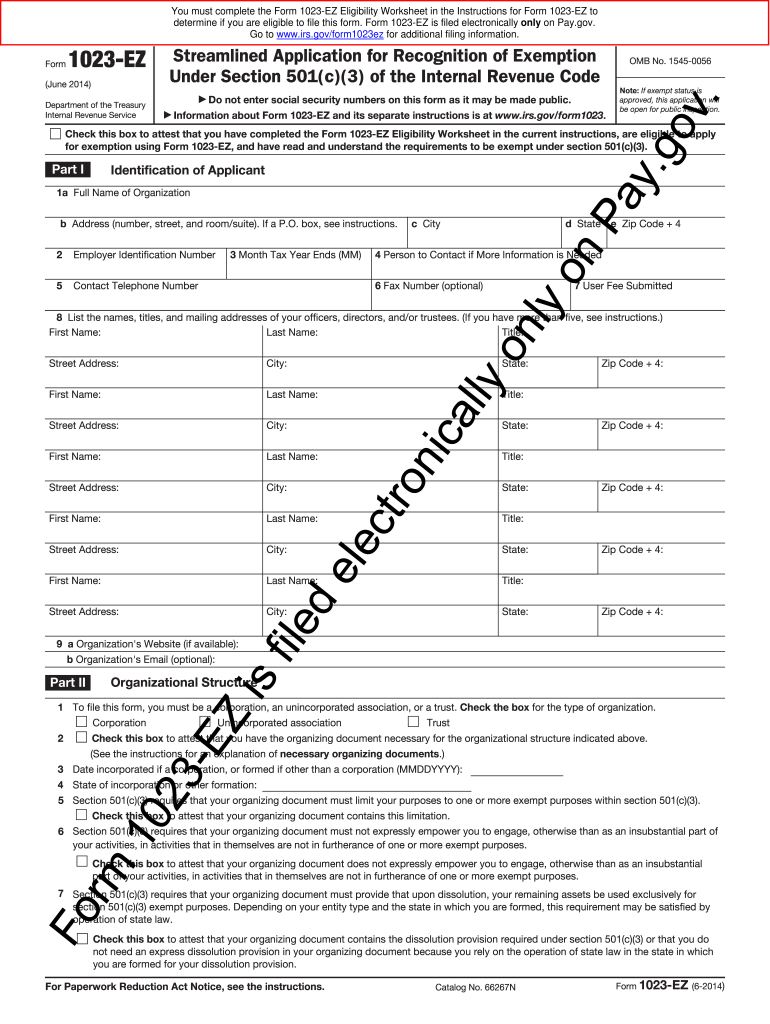

The 1023-EZ Form is used by organizations to apply for recognition of exemption from federal income tax under Section 501(c)(3) of the Internal Revenue Code. It is a shorter, simpler form designed to streamline the application process for small organizations that have gross receipts of $50,000 or less and total assets of $250,000 or less.

What information must be reported on 1023 ez form pdf?

The 1023-EZ form requires a filer to provide the following information:

- Entity name

- Entity type

- Tax identification number

- Mailing address

- Principal officer name

- Description of the organization's activities

- Total assets and liabilities

- Name and address of any related organizations

- Signature of the responsible party

When is the deadline to file 1023 ez form pdf in 2023?

The deadline to file Form 1023-EZ in 2023 is the 15th day of the 5th month after the end of the organization’s tax year. For most organizations, this will be May 15, 2024.

What is 1023 ez form pdf?

The 1023 EZ form is a simplified version of the IRS Form 1023, which is used to apply for tax-exempt status under section 501(c)(3) of the U.S. Internal Revenue Code. The 1023 EZ form allows small nonprofit organizations to apply for tax-exempt status more easily and quickly.

The form is provided in PDF format, which means it can be downloaded, filled out electronically or printed, and then submitted to the IRS. The PDF format ensures that the document retains its formatting and is easily readable across different devices and platforms.

Who is required to file 1023 ez form pdf?

The 1023 EZ form is required to be filed by organizations that are seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is specifically designed for smaller organizations with less than $50,000 in gross receipts per year and total assets of less than $250,000.

How to fill out 1023 ez form pdf?

To properly fill out the 1023 EZ form PDF, follow these steps:

1. Obtain the necessary form: Download the 1023 EZ form PDF from the official website of the Internal Revenue Service (IRS).

2. Read the instructions: Review the instructions provided with the form for guidance on filling it out correctly.

3. Gather required information: Collect all the necessary information and documents, such as the organization's legal name, address, Employer Identification Number (EIN), purpose of the organization, financial details, and more.

4. Part I - Identification of Applicant: Provide the organization's name, address, EIN, contact details, and the date of formation.

5. Part II - Organizational Structure: Indicate the type of organization (e.g., trust, corporation, association), the state where it was incorporated, and the type of exemption sought (e.g., charitable, educational).

6. Part III - Required Provisions: Check the boxes that accurately describe how the organization will operate and the manner in which its assets will be distributed upon dissolution. Make sure to read the instructions to determine the appropriate choices.

7. Part IV - Narrative Description: Briefly describe the organization's activities and purpose in detail. Provide solid justification for the eligibility of the desired tax-exempt status.

8. Part V - Required Attachments: Attach the mandatory documents, such as articles of incorporation, bylaws, and any other applicable documents mentioned in the instructions.

9. Part VI - Additional Information: Answer all the additional questions based on the organization's specific circumstances.

10. Part VII - User Fee: Determine the required user fee amount for your organization and make the necessary payment. Consult the instructions or IRS website for the current fee schedule.

11. Part VIII - Declaration of Agent: If applicable, have the authorized representative sign and date this section of the form.

12. Part IX - Declaration of Officer, Director, or Trustee: If applicable, have an officer, director, or trustee provide their information, sign, and date this section.

13. Review and submit: Thoroughly review the completed form, ensuring all required sections are filled, and attachments are included. Make a copy for your records. Then, submit the form via mail to the appropriate IRS address.

Remember that this is a simplified outline, so always consult the official instructions provided by the IRS for more detailed guidance. Additionally, seeking professional assistance from an accountant or tax attorney may be beneficial to ensure accuracy and compliance.

What is the penalty for the late filing of 1023 ez form pdf?

The penalty for late filing of Form 1023-EZ, which is the application for tax-exempt status under section 501(c)(3), can vary. Currently, the penalty is $20 per day for each day the application is late, with a maximum penalty of $10,000. However, there are certain exceptions and relief provisions for small organizations with gross receipts of $50,000 or less in their initial year. It is always advisable to consult with a tax professional or refer to the IRS guidelines for the most accurate and up-to-date information regarding penalties.

How do I modify my 1023 ez form pdf in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your sample completed 1023 ez form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the form 1023 ez pdf form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form 1023 ez and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit blank form 1023 ez on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 1023 ez example form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.